reverse sales tax calculator bc

Only four Canadian provinces have PST Provincial Sales Tax. In Québec it is called QST.

Amount without sales tax x HST rate100 Amount of HST in Ontario.

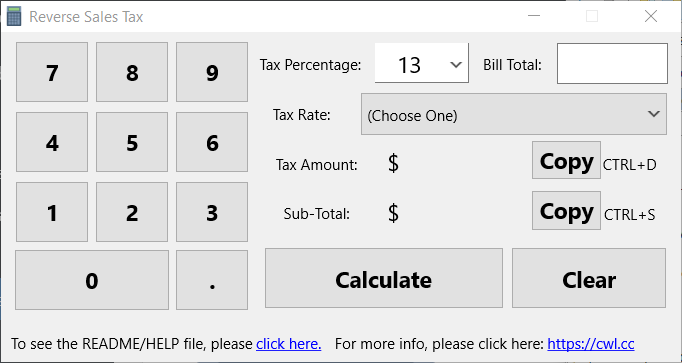

. How to use the reverse sales tax calculator. This tax calculator will help you to know the purchasesell amount before and after tax apply. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax.

There are also two taxes levied by the federal government. What is a sales tax. In Canada a Provincial Sales Tax PST is levied by the provinces.

Provinces and Territories with GST. Reverse Sales Tax Calculations. Calculates the canada reverse sales taxes HST GST and PST.

The following table provides the GST and HST provincial rates since July 1 2010. The information used to make the tax. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a.

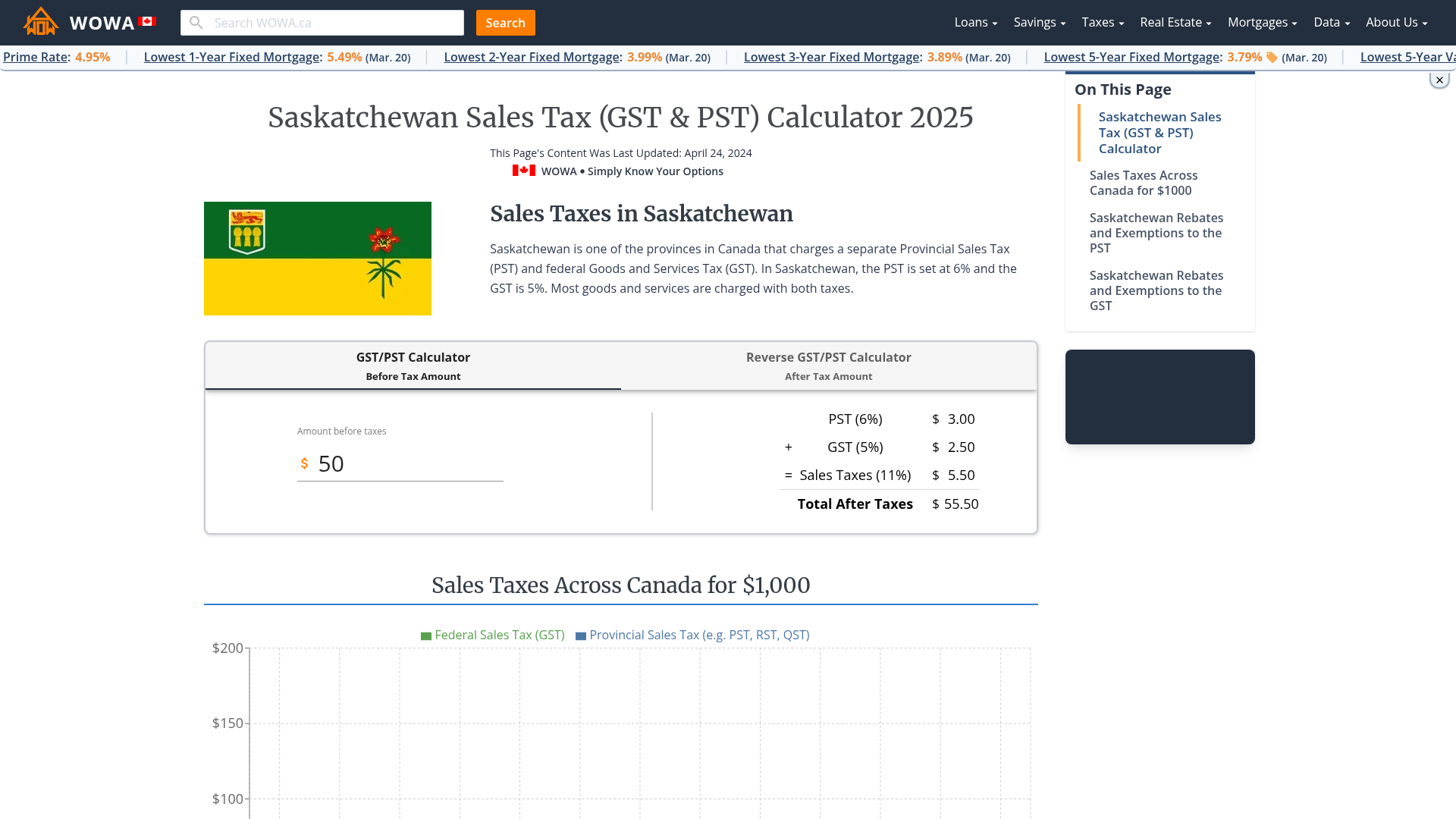

Before Tax Amount 000. British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST. Harmonized Sales Tax HST and Goods.

Alberta British Columbia BC Manitoba Northwest Territory Nunavut Quebec Saskatchewan Yukon. The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association. If youre selling an item and want to receive 000 after taxes youll need to sell.

The rate you will charge depends on different factors see. Type of supply learn about what. Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x.

Here is how the total is calculated before sales tax. Plus Tax Amount 000. Sales Tax Rates Calculator.

Minus Tax Amount 000. Why A Reverse Sales Tax Calculator is Useful. Sales Tax Calculators Canada Reverse Sales Tax Calculator.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Formula for calculating reverse GST and PST in BC. This simple PST calculator will help to.

Sales Taxes in British Columbia. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. British Columbia Manitoba Québec and Saskatchewan.

Reverse GST Calculator. Use this online tool whenever you need to check the amount of the items youve. Divide the price of the item post-tax by the decimal value.

Due to rounding of the amount without sales. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Using this reverse tax calculator is extremely simple and easy.

Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount. Reverse Sales Tax Formula. Margin of error for HST sales tax.

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

How To Calculate Sales Tax In Excel Tutorial Youtube

Washington Dc Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Canada Calculator On The App Store

How To Calculate Sales Tax Backwards From Total Reverse Tax Calculator

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Canada Sales Tax Calculator On The App Store

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Canada Sales Tax Calculator By Tardent Apps Inc

British Columbia Gst Calculator Gstcalculator Ca

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Canada Sales Tax Calculator By Tardent Apps Inc